So, the other day, I was messing around with some numbers, just trying to figure out a few things for my retirement plan. I’ve been thinking about this whole Social Security thing and when to start taking benefits. I know, I know, I’m only in my 50s, but hey, it’s never too early to plan, right?

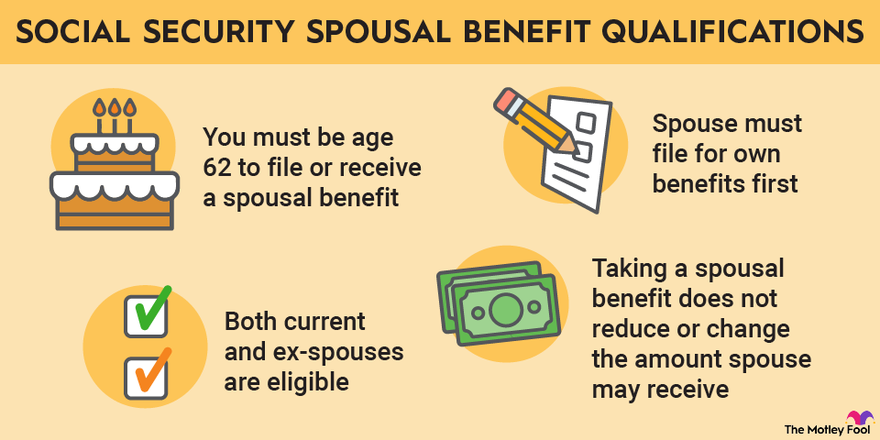

I remembered reading somewhere that you can start taking Social Security at 62, but you won’t get the full amount. I mean I don’t have the money to live on but I want to get full benefits, so I started playing around with some calculations.

First, I tried to do some long division, you know, the old-fashioned way, with pen and paper. I wanted to divide 62 by 16. Why 16? Honestly, I don’t even remember. Maybe I was tired or drunk, I don’t know. It took me a while, and I kept messing up, but I think I got close to the answer. It was something like 3 point something.

Then, because I’m a bit lazy, I grabbed my phone and used the calculator app. Typed in 62 divided by 16 and bam, 3.875. Easy peasy. The mixed fraction, or whatever it’s called, was 3 14/16. I guess that’s the same thing, just written differently.

After that, I started digging around for more info about Social Security. I found out that if I wait until my full retirement age, which I think is 67 for me, I’ll get more money each month. For example, I saw one place that said if you qualify for $2,000 per month at 67, and you take it early at 62, it drops to $1,400. Makes sense, I guess. They gotta incentivize people to wait, right?

I also stumbled upon some website that helps you simplify fractions. I tried putting in 62/16, just for kicks. It gave me the simplest form, which was apparently, well, a simpler version of the fraction. That was kind of cool, I guess.

My Realizations

- Started playing with retirement calculations, focusing on when to take Social Security.

- Tried long division of 62 by 16, then used a calculator to get 3.875.

- Learned about the difference in benefits between taking Social Security at 62 versus full retirement age.

- Found a website to simplify fractions, though not directly related to my main task.

Anyway, that’s my little adventure with numbers and retirement planning. It was a bit of a mess, with some long division, calculator use, and random fraction simplifying. But hey, I learned a few things along the way, and that’s what matters, right?